Those who read my blog often know that I see FinTech as the partnership between old bankers and young technology visionaries or, in context, a parent-child relationship. The parent wants stability and to maintain the status quo; the child wants to break down barriers and change the world. That’s a tough alignment, especially if you want it to be an equitable relationship. But that’s where we are at.

I then spotted an article yesterday that Wall Street is coming for crypto, whether early believers like it or not. Here’s the opening of that article:

At Money20/20 earlier this month, David Schwed, COO of Halborn, sent a message back to his team from the floor of the fintech conference in Amsterdam. “I’m happy,” he wrote. “I feel like there are adults here.” After attending crypto-centric conferences in Texas, Miami, and Barcelona over the past few weeks, he said seeing booths that belonged to JP Morgan, Citibank, and Goldman Sachs was a welcome change of scenery from fist bumps and late-night festivities.

You can read the rest of the article, but the gist is that cryptocurrencies have grown up and are now being adopted by mainstream financial institutions. Over the past few years, I’ve seen everything from JPMorgan, Citibank, State Street, BNY Mellon talking about how they are adopting transactional banking and custody services for corporate clients incorporating bitcoin, ETH, XRP and other cryptocurrencies.

Something has changed, and maybe the biggest change is that treasury managers want to use cryptocurrencies. If the customer wants it, then the big banks have to service it and there’s the rub. The big banks have stirred and incorporated digital assets, and specifically cryptocurrencies, into their remit.

And then you know that cryptocurrencies are going mainstream when Standard and Poor’s (S&P) start to rate them. They don’t do that today, but they are moving that way. For example, a new white paper assesses the risks of trading in DeFi: Decentralised Finance, which includes cryptocurrencies but also private tokens, NFTs and more.

In the paper, they found five key risks areas:

How DeFi's Operational Risks Could Influence Credit Quality

Key Takeaways

Decentralized finance (DeFi) systems introduce new operational risks that can affect the credit quality of issuers exposed to the sector and of digital financial instruments.

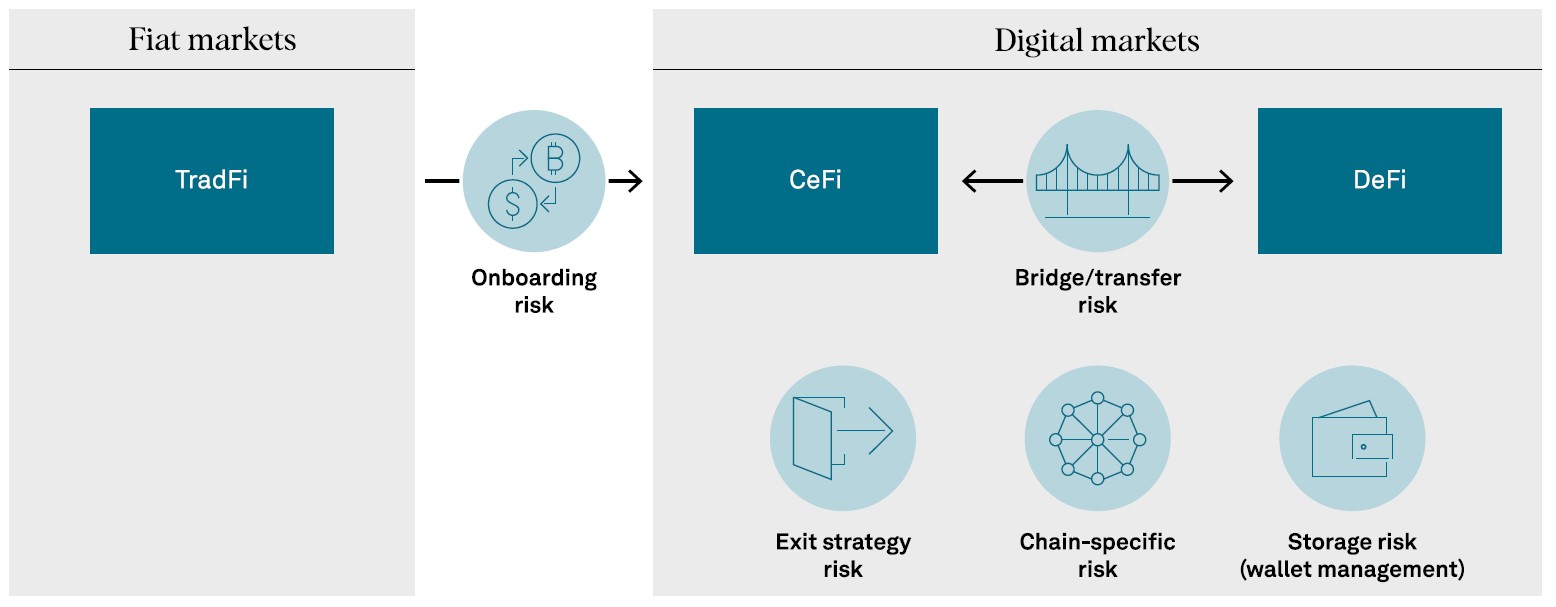

These risks span the life of a DeFi-based operation, beginning with onboarding risk, then bridge and transfer risk, storage risk, chain-specific risk, and concluding with exit strategy risk.

The threats primarily relate to fund-flow mechanics, security, and custody. They weigh on credit quality through their potential to interrupt, diminish, or result in the loss of cash flows to investors.

The recent emergence of DeFi means it remains one of the least understood sectors of the financial industry. That will have to change.

DeFi systems, which use blockchain technology to remove financial intermediaries, promise to revolutionize financial platforms and instruments by offering new levels of transparency, lower costs, and technological robustness. But the new technologies and systems also comes with novel operational risks that demand attention from nonfinancial companies, traditional finance (TradFi) players, and credit markets. Understanding this emerging technology's risks and their potential effects on credit quality has thus been a necessity for S&P Global Ratings.

For the time being that work remains largely preparatory. DeFi-based issuers of debt are rare, typically little connected to the "real" economy (including TradFi), and are yet to demand a rating from us.

The most important aspects of DeFi risk relate to fund flow mechanics, security, and custody.

You can find the full report below.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...