In most presentations, I use this quote from Charles Darwin:

It is not the most intellectual of the species that survives; it is not the strongest that survives; but the species that survives is the one that is able best to adapt and adjust to the changing environment in which it finds itself.

Although he never actually said this (it is a paraphrasing of The Origin of Species by Leon C. Megginson, Professor of Management and Marketing at Louisiana State University*), it’s a good quote to articulate the reasons why we need to change today.

The world’s axis has shifted from analogue to digital, and there is an urgency to change and adapt.

The adapt to change quote therefore provides the context for digital transformation well. The thing that’s missing is that if it is those are the most adaptable to change who survive, what should they change into?

This is what I grapple with every day. Where should a bank focus? What do they need to change into? Why and how?

The key to this is that you could change, but if you change in the wrong direction then the change will fail. If you start digital transformation the wrong way, the change will fail. If you delegate change to a function, a department, a Chief Change Officer, it will fail.

It’s a bit like, saying that you’re going to change but, for the moment, will leave that to a therapist.

This is why, more often than not, the digital transformation team are formed to do the digital transformation that the previous digital transformation team failed to deliver. It is why core systems refreshment is often presented as a five-year project requiring hundreds of millions of dollars in consulting and vendor fees when, in reality, it could be done for a million dollars if it were using BaaS (Banking-as-a-Service) with a digitally experienced team. It is why a fintech start-up believes they can achieve more in a month with a million dollars than a bank could achieve in a year with $100 million dollars.

The critical factor worth underscoring here is the fact that this has nothing to do with change. It is to do with change into what? If you change the wrong way, then that does not work … but how do you find the right way? That is the biggest issue for most banks when dealing with digital transformation. What is it that you need to change into and how?

A critical factor in answer to this question is that it cannot be fixed. It cannot be a five year project or one that is delegated. It is a change that is dynamic and can reset or recharge in real-time anytime.

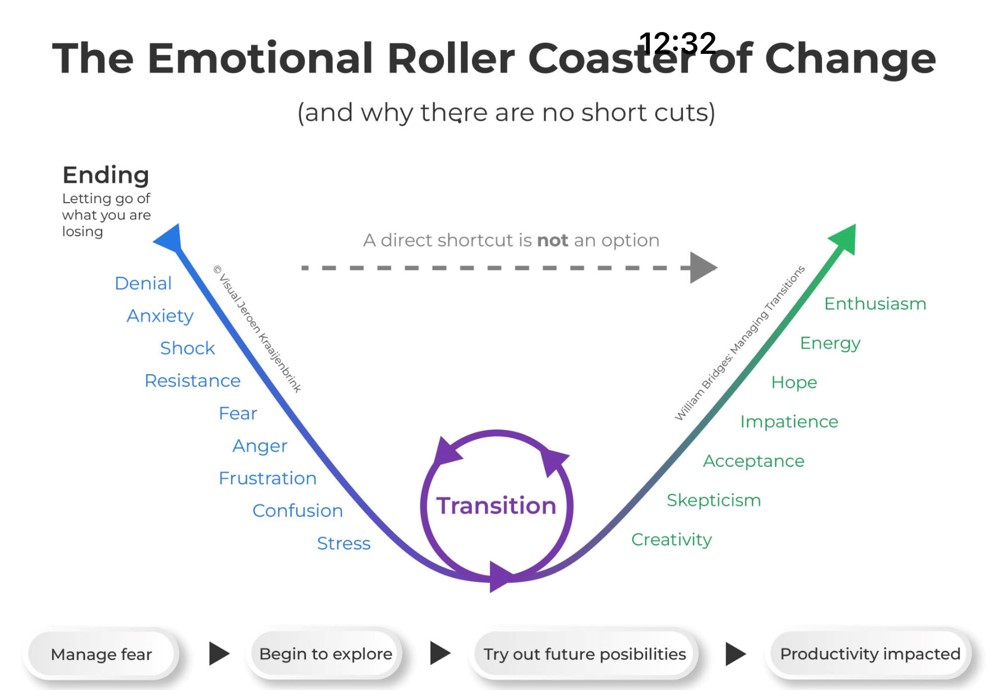

Even then, even if you find the right way to change, even if the executive team are all behind it, even if it is not a project but an enterprise-wide change programme, there will be issues because people don’t like change. The natural reaction to asking someone to change is resistance. Think of your own experiences: eat less, get healthy, give up smoking and drinking, live healthy and such like; it is hard. In fact, I loved this chart that I picked up the other day about change:

A bit like grief, you go through anger, denial, confusion and stress. Then, finally, you get there. You accept the change. You embrace it. The only question then is: is it the right change?

* It’s a bit like the quote “survival of the fittest” is often attributed to Charles Darwin, but that one was by Herbert Spencer

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...