I’ve written a lot about JPMorgan for over two decades, ever since Jamie Dimon took over the bank in 2004. Back then, it was notable that he made a decision to revoke a massive ten-year outsourcing contract with IBM.

Industry watchers see Dimon's fingerprints on Chase's decision, announced Wednesday, to cancel the company's $5 billion, 10-year "business-transformation-outsourcing" contract it signed with IBM in late 2002. "After the Bank One experience, he's become a big believer in doing things in-house," an analyst says.

It really dates back to the 1980s when Dimon realised that technology is the differentiator in delivering finance. Ever since, he’s followed through with that vision and built a bank that was floundering into the world’s largest.

https://youtu.be/-7tHz5JQpM0

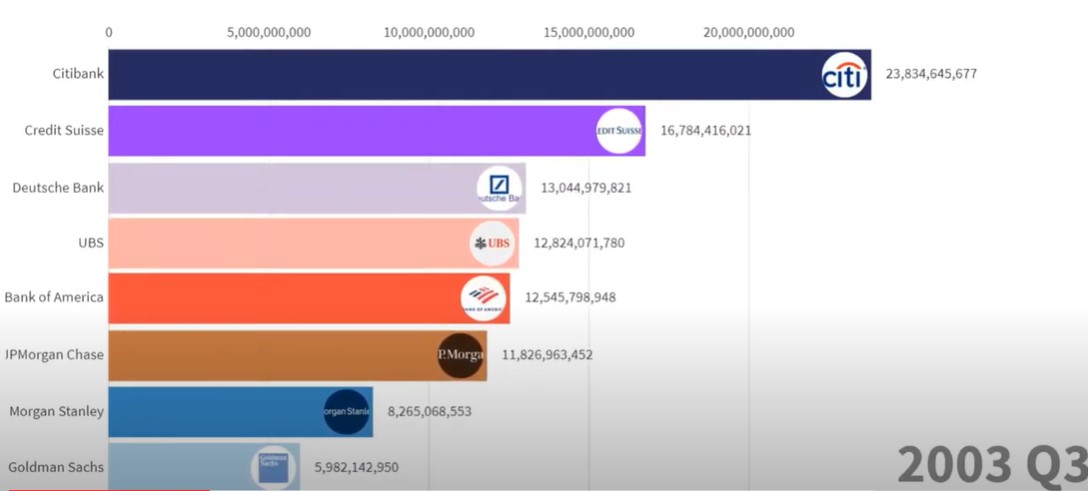

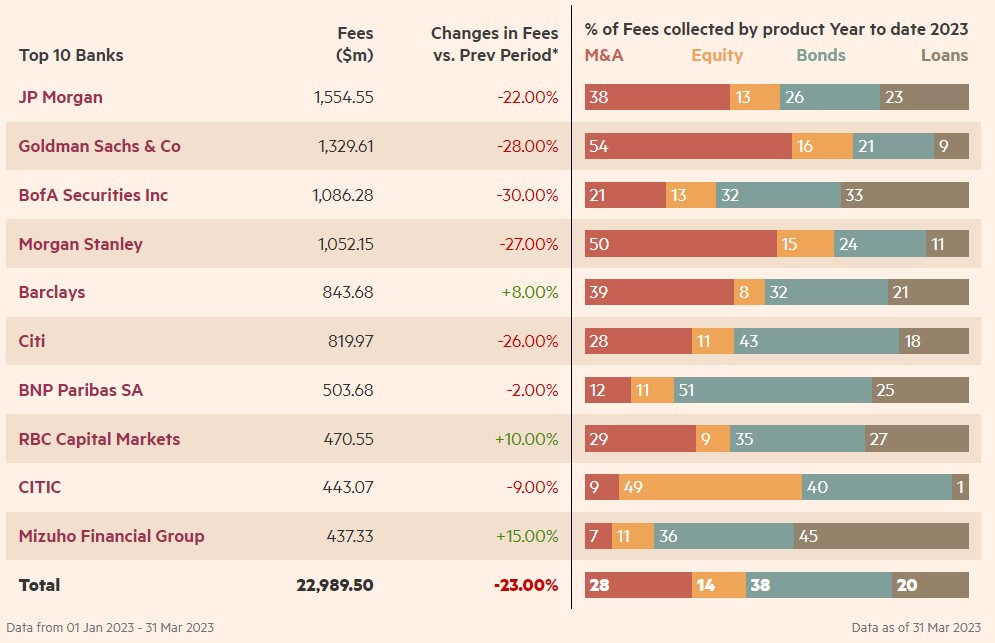

Today, it is recognised as the leading investment bank …

Source: Financial Times

… all driven by Jamie Dimon’s strong vision to use technology to lead banking.

It is the same philosophy he has applied to their retail operations and Chase in the USA. This featured heavily in my book Doing Digital, where I interviewed his leaders to find out how they approached digital transformation in their retail operations. My main memory of those interviews was a singular focus on the customer, the customer journey and the customer experience.

Some may disagree with that summation but, nevertheless, Chase is the leading bank in the USA.

But Jamie Dimon is not a Lone Ranger. He has his Tonto (for younger readers it’s a long story, but think of Batman and Robin or Iron Man and Spiderman).

Jamie’s sidekick is Daniel Pinto and he just had a very interesting report from Business Insider of his speech at the Bernstein Strategic Decisions conference:

“In the past, we always said, ‘There is no way that we are going to do retail outside the United States’, and went on to explain that “the retail business in the United States is an amazing business, very profitable, massive scale, great set of products, very good but you never know when it could be disrupted by someone, by the technology platform and someone else. So we see this as a way over the long, long term to diversify and complement our fantastic US retail business.”

What’s he talking about?

The expansion of the retail business into Europe and the strategy of the bank to resist fintech disruption.

For example, last year it was revealed that JP Morgan had splashed around $450 million on the launch of Chase UK but also gained in £8 billion of savers deposits in only eight months.

Now, they are looking to expand the retail bank further into Europe, and launch a digital bank in Germany in either late 2024 or early 2025, according to Bloomberg News.

On the FinTech side, the bank has seen this as an existential threat since Jamie’s shareholder letter update of 2015, where he stated “Silicon Valley is coming to eat our lunch”. In fact, he was talking about this in 2014.

Speaking at the U.S. bank's investor day on Tuesday, Mr. Dimon said tech firms were among the main competitors the bank could face in the future. “When I go to Silicon Valley…they all want to eat our lunch. Every single one of them is going to try”, he said.

Wall Street Journal, February 2014

He followed that up in his shareholder letter of 2015 by stating:

“There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking. The ones you read about most are in the lending business, whereby the firms can lend to individuals and small businesses very quickly and — these entities believe — effectively by using Big Data to enhance credit underwriting. They are very good at reducing the 'pain points' in that they can make loans in minutes, which might take banks weeks. We are going to work hard to make our services as seamless and competitive as theirs. And we also are completely comfortable with partnering where it makes sense.”

This focus on technology threats has led to major investments and, more recently, acquisitions of FinTech firms and technologies over the past decade. The bank has made at least 16 fintech or consumer-focused acquisitions since 2020. JPMorgan are using them as part of building their Lego Bank model.

Even more interesting is the fact that it is spending billions on technology, and over half of it focused upon innovation and expansion. JPMorgan plans to spend $15.3 billion on tech in 2023, up from $14 billion in 2022 and, notably, expects to make even more acquisitions and to continue to spend on new technologies as it seeks to keep its competitive edge across business lines.

I’ve written lots about the bank in the past, mainly because Jamie Dimon’s view that technology or digital transformation, as we call it these days, is the key to becoming the world’s largest bank. I totally agree.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...