I’ve written quite a lot about Revolut and Monzo, as well as many other challenger banks. Now, as we hit hard times with rising inflation, interest rates and a recession looming in so many markets what’s the state of the fintech nation? Well, it’s challenging for challengers. Some are doing well, but many are being called out for flawed business models and numbers that don’t make sense. When you see the likes of Signature Bank and Silicon Valley Bank fall, there’s something going on.

Interestingly, that house of cards hasn’t fallen on the European challengers - so far, it's mainly American banks - but there was an article that jumped out at me this week from Sifted questioning N26. Miriam Partington writes that Regulatory issues, executive churn and a shutdown of the public markets have set the neobank back on its IPO plans.

A few lines jumped out in particular:

N26’s net losses rose to €172m in 2021 and its administrative costs grew 47% to €167.7m due to increased spending on regulatory compliance … in 2021, N26’s revenue grew by 60% year on year. But the largest chunk of that revenue (40%) was made up of subscriptions, which are typically low margin.

She highlights that “the first hurdle in N26 getting ready for life as a public company will be achieving profitability” and yet, as I’ve referred to regularly N26’s co-founder Maximilian Tayenthal told the Financial Times that “in all honesty, profitability is not one of our core metrics”.

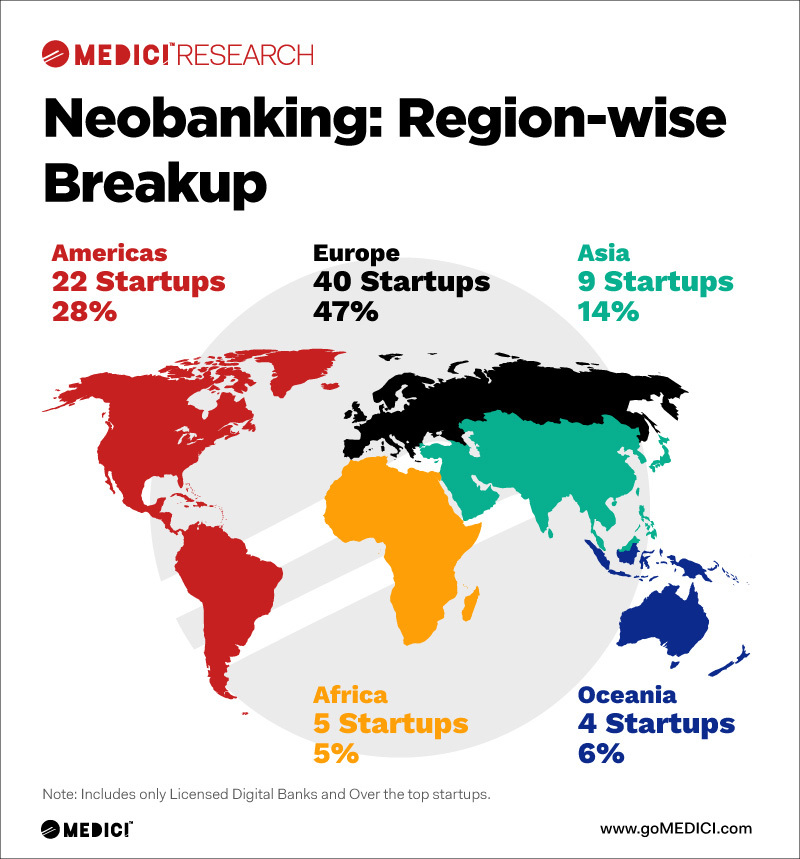

And this brings us to the core of where we are today. Perhaps it is best illustrated by this update I got from FinFan, who highlight that there are over 80 neobank or challenger banks in the world, but how many are viable?

The article mentions the 10 large neobanks it sees as relevant including Chime, Varo, Monzo and N26; but it also mentions Revolut and Klarna which aren’t banks, as they don’t have a banking license; and misses Nubank, South America, the biggest challenger bank in the world; which makes the article weaker but still worth a read. The thing is that we talk about challenger banks and neobanks and the problem is: what is a bank?

The question is so simple it seems silly: What is a bank?

Of course you know the answer. A bank pools savings and then allocates that capital. Simple, right? But that’s just the start. Today, a big bank also doubles as an enterprise software company and a mobile-apps developer. It is a customer-service organisation to big companies and individuals alike. It is a tool of government-mandated social policy. A shareholder-return engine. An international intermediary. A seller and trader of securities. A policeman of criminals. A policeman of itself.

Source: Wall Street Journal

But I actually disagree with The Wall Street Journal. A bank is not needed for transactions, payments, savings, investments, credit, mortages or loans. A bank is needed for the trust of storing value because it is backed by a guarantee scheme from the government, and the banks job is to manage risk. A banks job is to ensure it does not lose our money. That's the core thing, and the reason why you need a government-issued license to be a bank.

Anyway, going back to N26, as it’s been known for a long time as being dysfunctional and run with a culture of fear (as has Revolut) but, more importantly, N26 claimed that profitability is not one of their metrics. Maybe that is going to cause them issues in 2023 as investors are saying:

“We don’t want to invest in a company where we know there’s a highly demotivated management and pissed off older shareholders”

Source: Sifted

Postnote:

Sifted has also just published an interesting note on Revolut's future:

Revolut is a poster child for UK tech, and has been endorsed by the prime minister himself as a “fintech success story”. If Revolut quit the UK it would be a huge setback for the government’s “science and tech superpower“ ambitions, say investors and founders.

Postnote2:

Comment from Arcady Lapiro, CEO & Founder Agora, via LinkedIn:

- challenger banks have struggled to turn large user bases into a profitable business model

- some investors are starting to question how sustainable challenger banks are and how the growing response from traditional banks impacts their long-term future.

- Community banks and credit unions can learn from this approach by taking a hard look at their own user experience. Where can they enhance their products and service levels to match or exceed the experience provided by challenger banks?

- Interest-based, interchange, loans and fee-based services can all provide a healthy path to profitability. vs interchange fee & freemium business model only ...

- user experience and interchange volumes alone won’t drive the value required for either consumers or account providers

- challenger banks and traditional banks will both need to figure out the best mix of products and services to grow over the next decade. The winners will be those that best meet three standards: Is it relevant to the customer? Are the fees transparent and fair? Is the user experience simple and ubiquitous?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...