After Brexit, I hear and read a lot of negative things about doing business with Britain these days. The latest is Revolut complaining that Britain doesn’t like them. That’s not true. It’s more to do with Revolut cannot deliver their accounts on time (they blame the regulator for this) and cannot get the banking licence they want (they blame the regulator for this). In a conversation during the Web Summit last week in Rio de Janeiro, they go on to say that they won’t list Revolut in London if they IPO (they blame the regulator for this) and a general lack of support for tech start-ups in the UK compared to the USA (they blame the regulator for this).

They blame the regulator a lot.

“US tech champions are so supported by the government: all the lobbyists, politicians, governors, they always promote business, business, business and it is completely the opposite in the UK. We have experienced a slowing down. You never know what needs to be done here.” Nik Storonsky, co-founder and CEO, Revolut

They also blame the collapse of West Coast American banks:

“Ultimately it is not really us, it is generally the banking crisis we see at the moment that makes regulators extra cautious,” Storonsky told the Financial Times of the hold-up to the UK licence approval.

But this is the company that the UK Chancellor, Jeremy Hunt, describes as a jewel in Britain’s technology crown. In a recent speech, Jeremy called for Brits to have a more American approach, saying the attitude to risk in the UK “can still be more cautious compared to our US friends. We have Monzo and Revolut, shining examples from our world-beating fintech sector,” Hunt said. “You are all vital for Britain’s economic future, but Britain is vital for your future too, so I want to ask all of you to help our country achieve something that is both ambitious and strategic. I want to ask you to help turn the UK into the world’s next Silicon Valley.”

This is interesting, as the government is a little bit schizophrenic in approach as the regulator won't give Revolut a banking licence, which is why Storonsky is whining, whilst it doesn't want Revolut to leave Britain.

Kemi Badenoch, the Business Secretary, is seeking an emergency meeting with Revolut over fears the $33bn (£26bn) technology company may abandon the UK amid frustration with high taxes and red tape.

As we discussed in FinTech Uncut last week the UK Prime Minister has, on the one hand, announced that the UK should be the crypto capital of the world; then, on the other hand, he announces issues with mass fraud and scams, specifically related to crypto assets, and calls to ban such schemes.

I can kind of relate to the sentiment but am just not sure how you can encourage the growth of crypto schemes whilst trying to ban the criminals who leverage such schemes. Having said that, maybe it’s just like banking. You can become the banking centre of the world whilst, at the same time, trying to stop criminals buck the banking system. It is just difficult to do this and you have to find the right balance. Too much regulation kills the system; too little allows the system to be killed.

Maybe that is the point that Revolut is trying to make. If you regulate us too much, we will leave; if you regulate us too little, we will get away with anything we want.

Nevertheless, there is a critical point that occurs here, and the UK Government is possibly losing the plot. Since Brexit, a lot of business has been lost by the City of London. Dublin, Paris, Frankfurt, Milan, Amsterdam and Luxembourg have all gained.

Paul Mason notes in The New European that more than £1 trillion worth of investments have fled the banking and insurance system for the European Union since Brexit.

Amsterdam has supplanted London as the centre for trading European stocks. Paris overtook London as Europe’s most valuable stock exchange [in November 2022]. Meanwhile, the EU’s financial regulator has signalled it will force large parts of London’s derivatives market – worth a staggering $26 trillion a year – to relocate to trading platforms on European soil after 2024.

Bloomberg notes that Paris has become the clear post-Brexit winner.

JPMorgan Chase & Co. has about 550 markets staff including sales people and traders in the city now, a 22-fold increase on 2019. Bank of America Corp.’s headcount — at 600 — is six times higher than before the 2016 Brexit vote. Citigroup Inc. is building a new trading floor around the corner from the Avenue des Champs-Élysées. Morgan Stanley is also adding staff in Paris and creating a new research center to support trading. And the global markets team at Goldman Sachs Group Inc. has more than doubled in the last two years, and the bank sees those numbers increasing further.

It gets worse. As Ophelia Brown, founder of VC fund Blossom Capital, notes in The Times:

Momentum is ebbing away from the UK capital faster than from other cities. In the first quarter of this year venture capital (VC) investment in London collapsed by 79 per cent to $2.1 billion. In contrast Berlin experienced only a 42 per cent fall in its venture capital funding, from $1.6 billion to $925 million, and Paris’s venture capital slid by 68 per cent, from $3.8 billion to $1.2 billion. In Paris and elsewhere there is a view that London’s crown is for the taking.

She goes on to say that it’s almost two years since her fund have seen any firm worth investing in in Britain.

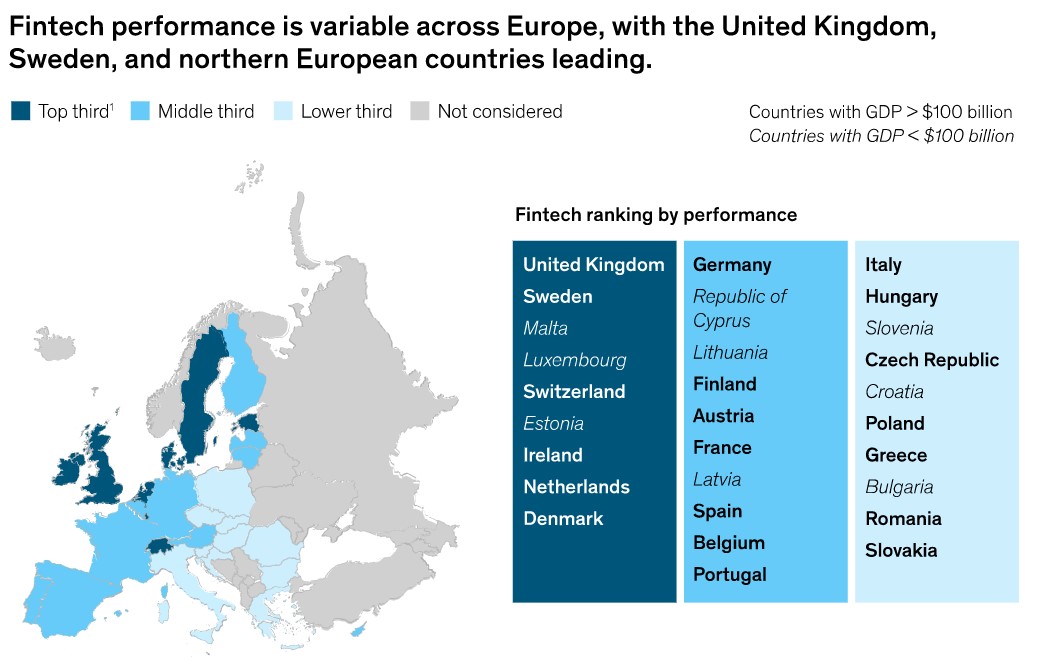

Strange as she can’t really have been watching the FinTech leadership of the UK. As this McKinsey report highlights, the UK and Sweden lead European start-ups in FinTech, with the UK being the best place for early and late stage funding.

The United Kingdom led the European market with a total volume of approximately €1.3 billion for early-stage funding and €8.3 billion for late-stage funding in 2021. That performance compares favorably with other countries, including the United States: while US GDP is about ten times larger than the United Kingdom’s, US spending on funding is only four times larger.

So maybe Ophelia has been looking in the wrong places? Maybe Nik Storonsky and his team have too. After all, the UK still has lots of positives if you know how the system works and, possibly, this is where Revolut has got it wrong. They are demanding a fast track to be a UK bank, but no one wants to fast track challenger banks anymore, especially after what's been happening in West Coast USA with Signature, Silvergate and Silicon Valley banks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...