I haven't written about Green Finance for a while, but then saw this over on Bloomberg and couldn't resist sharing.

The need for a global greenwashing framework by Tim Quinson, Bloomberg

Greenwashing may be the biggest risk to the future of ESG investing, but there’s no firm agreement on what it means in a legal or regulatory context. The term has become ubiquitous with the rise of ESG. It’s typically used when companies, people or governments overstate, misrepresent or just plain lie about their climate credentials. For example, a company says it’s reducing its carbon footprint—but fails to say that the calculation excludes massive emissions produced by its customers or suppliers. Or an asset manager overhypes the environmental, social and governance standards it uses to allocate clients’ money. But know-it-when-you-see-it doesn’t translate well into statutory authority.

“The battle to stamp out greenwashing continues to be foiled by the lack of a clear and common definition across jurisdictions,” said Maia Godemer, a London-based sustainable finance analyst at BloombergNEF. “The market can only continue to flourish if regulators build a common framework around what is considered environmentally or socially sustainable.”

Policymakers in Europe have been the most aggressive in trying to flesh out such a framework, but complications continue to emerge.

The European Securities and Markets Authority lists tackling greenwashing among its top priorities. But the markets watchdog struggles to specifically describe what it is. In November, ESMA along with the European Banking Authority and the European Insurance and Occupational Pensions Authority launched a joint review to gauge the scale of exaggerated ESG investing statements. It’s part of an effort to evaluate how well existing regulations are working, and “to gather useful and concrete examples that will help the ESAs to better understand greenwashing,” according to the document.

The results of the European regulatory effort have been dramatic. Many asset managers have been forced to stop claiming levels of sustainability in their investments that don’t meet the standard under the new rules.

But the lack of conformity among agencies and jurisdictions is “leading to misinterpretation and inconsistent application of the rules,” Godemer said. Unless there’s more clarity and consistency, she said it’s likely investors will simply pare back their holdings of funds advertised as sustainable.

The European Union’s Sustainable Finance Disclosure Regulation may arguably be a prime example of that. Instead of providing a uniform interpretation of what’s an ESG fund and what’s not, it’s prompted concern that investors have put their money in funds marketed as pure-play ESG products when they aren’t.

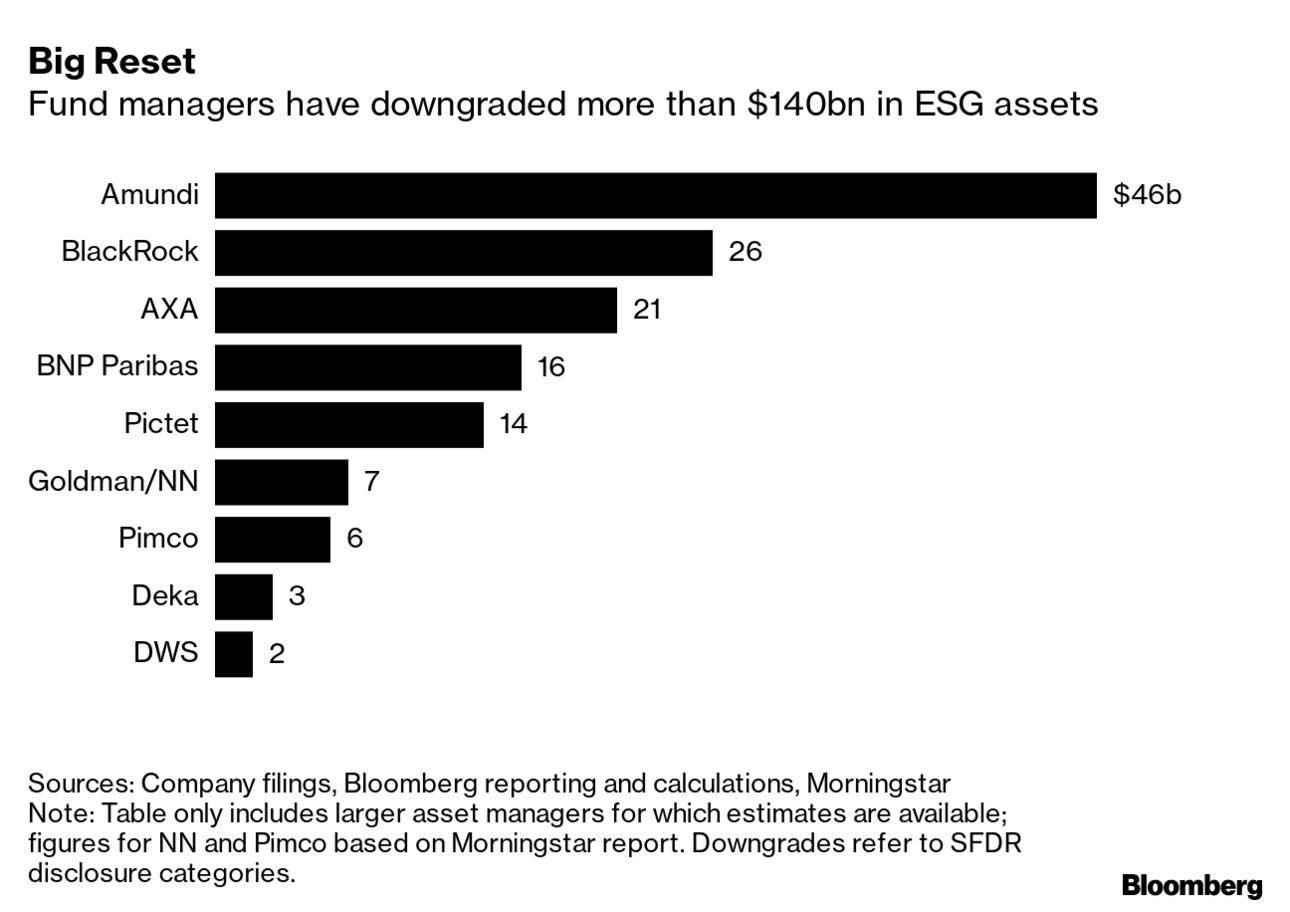

During the second half of last year, financial giants including BlackRock Inc., Amundi SA, Axa Investment Managers and the investment arm of Banque Pictet & Cie SA stopped claiming that $140 billion worth of their funds actually qualified for the EU’s top ESG designation, known as Article 9. Why? Because the EU clarified its definition of Article 9 funds, saying the labeling must be reserved, with few exceptions, for 100% sustainable investments. Now there are calls for the European Commission and ESMA to ensure transparency by financial firms when they are forced to reclassify funds.

Retail clients fearful of being exposed to greenwashing have started pointing fingers at those firms, accusing them of keeping the flow of information on ESG downgrades to a minimum. And it’s not just the fund industry where company confusion and investor anger is rising. The fast-growing market for sustainability-linked bonds also has been tainted.

“Financial market participants also need to ramp up their knowledge and educate themselves,” Godemer said. Countries “will never completely agree on fully aligning their standards,” but regulators should at least develop an international structure that covers “the baseline of sustainability reporting.”

If they don’t, she warns, the result will be more greenwashing-related litigation.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...