I’ve been talking a lot about DeFi, CeFi and HyFi, and someone said: what about ReFi? ReFi? What’s that? Well, ReFi is all about Regenerative Finance, a system to rebuild Earth. Therefore, I’m pleased to share a second post by Letty Prados. Last month, I shared her introduction about ReFi. Here is Part II!

If you haven’t read yet Part I of this exploration on “What is Regenerative Finance? (ReFi)”, read this first as you will get a clearer picture on its origins and foundations. Suffice here to remember that ReFi is based on the theory of regenerative economics and is leveraging Web3 to address climate justice and equity.

If carefully looked together, the principles that both John Fullerton and Dr. Sally Goerner have brought forth to assess what regenerative economics is provide us with a genius blueprint for empirical implementation, highlighted by the following four points contained in this article. It is worth noting that regenerative economics is also a theory of political economy that transcends the current contemporary dualistic debate. It is more akin to what Riane Eisler has been advocating for decades: partnerism, a more caring social and economic system which goes beyond the old thinking of capitalism/socialism and includes the life-sustaining sectors (household economy, unpaid community and creative economy, natural economy).

Partnerism: a socio-economic system that values and rewards caring for one another, nature, and our collective future. A socio-economic system where all relationships, institutions, policies, and organizations are based on principles of equitable partnership that supports linking rather than ranking and hierarchies of actualization rather than hierarchies of domination.

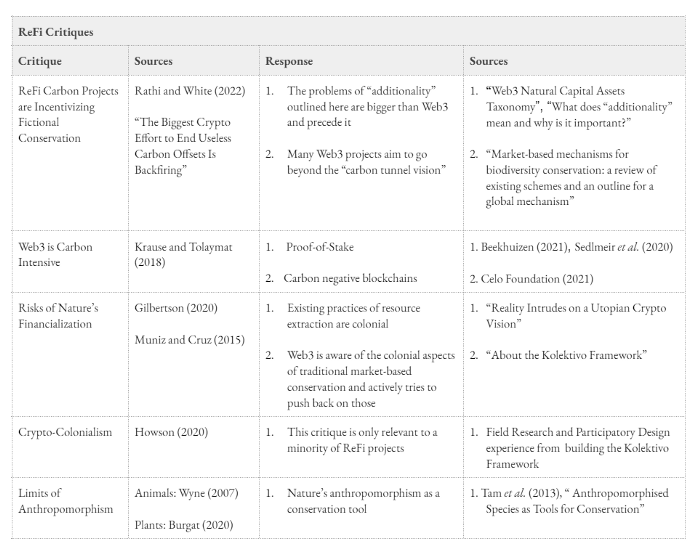

1. Addressing ReFi’s Critiques

A socio-economic system that embodies the principles and characteristics explained above can be very well served by ReFi tools which, at their core, aim to create models and protocols that evolve all physical and natural resources essential for human and planetary wellbeing.

However, as this recent research article by Curve Labs highlights, many critics have already raised their voices “alleging that blockchains are a step back: they simply replicate traditional power structures and preserve structural inequalities. Beyond this, Web3 proponents are often dismissed as being too eager to financialize new types of digital assets”.

To provide a complete overview of ReFi’s merits and demerits, we should certainly pay attention to what these critiques point towards, mainly the argument made against the perceived financialization of the everyday. This argument seems to stem from the sentiment that nature (or Nature in this case) is so sacred that it shouldn’t be spoiled by “money”.

These arguments address the following topics as Curve Labs explain: the quality/status of ReFi carbon projects, but whose carbon offset verification and veracity issues run deeper than the market shifts in patterns of trading and price change; and the argument that web3 is Energy Intensive due to proof-of-work (PoW), an energy-intensive consensus mechanism required to validate transitions of some cryptocurrencies versus the much less energy intensive proof-of-stake (PoS) consensus mechanism.

Also the critiques around the risks of Nature’s financialization whereas we like to admit it or not, forests, rivers, and animals are already enmeshed in a globally-spanning capitalist system; web3 crypto-colonialism perpetuating (or even accentuating) existing colonial path dependencies; and the limits that anthropomorphism pose as threat to objective scientific knowledge production while rather we could argue anthropomorphism has important societal benefits as it brings humans closer to nature, inspiring and enabling us to protect it.

The table shown below, extracted from the research article mentioned, outlines some of the main arguments and counterarguments to Regenerative Finance, supported by both academic research and industry insights.

2. ReFi’s Responses and Solutions

The core idea that lies behind ReFi is designing for living systems and for a living system inspired economy. In this kind of economy, currencies will facilitate and adopt patterns of balanced energy flows. This way, currencies will serve different functions and will healthily flow in right relationship to the need they respond to. They will be spent in balance and in service of all activities that are life-sustaining, expanding wealth in communities as well as trust and coherence at all levels: locally, bioregionally and globally.

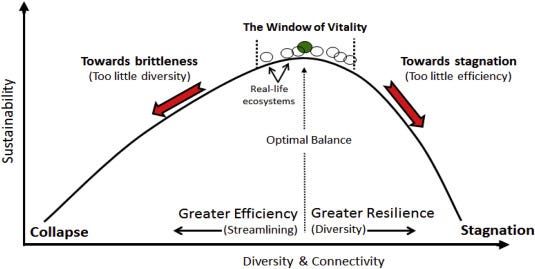

Thus, following energy networks science postulates by Dr. Sally Goerner, economic activity will be aligned with the natural flow of energy and resources in the specific bioregion and globally. In a virtuous circle, communities, regions, institutions and businesses will maintain a healthy balance of resilience and efficiency needed for systemic health.

With a balanced interaction among the different kinds of capital (natural, social, human and built capital) that result in human well-being, the proper accounting of ecosystem services can also contribute towards that wellbeing. The most thorough response to the critique about the perceived financialization or commodification of nature made by the implementation of eco-services and ReFi models has been given by Dr. Robert Costanza and al. in their 2014 paper:

We emphasize that valuation of eco-services (in whatever units) is not the same as commodification or privatization. Many eco-services are best considered public goods or common pool resources, so conventional markets are often not the best institutional frameworks to manage them. However, these services must be (and are being) valued, and we need new, common asset institutions to better take these values into account.

There is a clear momentum for all this. An an example, many industry leaders such as the Energy Web Foundation , enterprises like Nori, carbon market projects like to Toucan Protocol and Klima DAO, the Celo blockchain and Regen Network project and, finally, coalitions and groups such as The Sovereign Nature Initiative, The Climate Chain Coalition, The Open Earth Foundation, The Climate Ledger Initiative, The Climate Collective or The Capital Coalition are working inside the cryptosphere’s emerging environmental movement.

3. The Toolkit: Regenerative Tokenomics

All the groups and projects forming around ReFi are tackling the conspicuous issues posed by climate change, the accelerating loss of biodiversity, disparities in wealth, political instability, or pandemics.

As stated by Angela Kreitenweis, all these challenges depend on economic incentives. If we don’t get economic incentives right, there’s no hope for bringing about needed global structural shifts, such as accounting for negative externalities. Token-based economies offer a whole new toolkit for (re-)shaping economies:

- infrastructure for implementing and enforcing policies at the micro level;

- data for aggregating, monitoring and optimizing economic transactions at the macro level;

- and governance mechanisms for continuously balancing the interests of stakeholders across the globe.

Token engineering can contribute enormously to solve the mentioned challenges. But it also needs to be rooted on adequate ethics and living system principles.

One of the most cutting-edge mechanisms under a token engineer tool belt is using the eight forms of Capital to drive systematic, sustainable, and positive change for all stakeholders. How to do it?: accounting and connecting in a balanced and flow networked relationship all eight forms of capital and currencies shown below with integral worldview principles (as developed by Ken Wilber) and integral TE ethics.

Without losing perspective of the limitations of token incentives or as Sebnem Rusitschka would put it: “we should stop tugging at the symptoms and changing behaviour with incentives (literal token economy for the “insane”) and go much deeper individually and collectively; however somehow the idea to use token economy to get us there is enticing”. A golden rule for ethical token engineering will encapsulate this wisdom shared in the Omega group of Token Engineering Commons: “forecasting and backcasting is outcome-based” — meaning we assume we already know what is the best outcome. Reverse game theory is you want an outcome and engineer incentives such that via tokenomics those outcomes are reached. Unless the “outcome” and objective is “adaptivity” that type of token engineering actually is harmful”.

4. An integral approach: the RCD framework in action

The vision and mission is clear, in Smitman’s (2019) words:

Our current sustainability crisis reveals a deeper systemic behavioral pattern, discussed in this paper as the polarization effect that gave rise to our mechanistic worldviews. This effect is in part driven by our attempts to control our natural world to suit our economic needs via technological advancements that have decreased our reciprocity with our natural systems. This has also resulted in a loss of evolutionary coherence in our human made systems and increase in entropy.

Our challenge now is how to (re)design our systems such that the systemic behaviors of which we are part cease to bring forth this divisive polarization effect. To (re)design our human systems in such a way that we finally become evolutionary coherent and supercoherent with our planetary and cosmic systems.

One of the practical scientific frameworks we can apply generatively on the ground, embedded with ReFi solutions, is the Regenerative Community Development Framework by Dr. Leah Gibbons of the Regenerative Living Institute:

This framework, as explained in this 2020 paper, guides communities in perceiving/discovering relationships and patterns that give, have given, or need to be present to bring life and vitality to a place. It helps people work holistically with complex living systems, exploring key life-giving elements and their relationships across scales. Trough this process, key life-giving patterns emerge that provide the basis for regenerative development concepts and designs specific to a place.

RCD’s holistic approach integrates ecological and sociocultural dimensions of existence, process and product domains of development and design efforts, and inner and outer dimensions of sustainability, as well as their spatial and temporal dynamics. (…) Its processes and tools help inhabitants better understand life-giving flows (e.g., water, food, energy, organisms, information) through their community and the communities of which they are a part of, as well as their relationships and the emergence that occurs. It translates living systems principles and characteristics into general indicators and strategies for whole-system health and regeneration that are then made specific to a place through ongoing cocreative processes.

These processes help the inhabitants and stakeholders of a place to integrate ecological and sociocultural dimensions of living systems (i.e., human–nature interactions), as well as development and design processes (e.g., participatory processes in urban design and landscape architecture) and products (e.g., ecological urban infrastructure, city plans and codes, buildings, and water systems) that are necessarily involved in community development, thus, guiding community development in space and time in an ontological feedback loop. In short, RCD seeks to develop regenerative cultures that form the matrix out of which all aspects of regenerative being, regenerative living, and regenerative whole living systems arise.

5. Conclusion

Be aware that for ReFi and regenerative tokenomics to be truly regenerative, all aspects and dimensions (internal and external) need to be integrated. The principles and solution proposed here to develop and apply integral regenerative tokenomics at scale following the RCD framework is only viable if the internal dimensions of human regeneration are equally taken care of by all.

Find out more about the collective impact initiative “Regen Living Ecosystem”, regenliving.eco, to be part of a global network of regenerators changing the world through place-based regenerative projects. Join our Discord community or Twitter.

A special thank you to Neil Takemoto for your helpful review and wonderful graphics.

References

- Costanza, R. and Hernandez, C. 2014. Natural capital and ecosystem services.

- Curve Labs. Web3 Natural Capital Assets Taxonomy

- Curve Labs. The Promises and Pitfalls of Regenerative Finance.

- Fullerton, J. 2015. Regenerative Capitalism.

- Gibbons, L.V. 2020. Moving Beyond Sustainability: A Regenerative Community Development Framework for Co-creating Thriving Living Systems and Its Application.

- Gibbons, L.V. 2020. Regenerative — The New Sustainable.

- Goerner, S. 2019. Measuring regenerative economics: 10 principles and measures undergirding systemic economic health.

- Kreitenweis, A. Token based economies.

- Landua G. and Roland, E. 8 Forms of Capital.

- Smitsman, A. 2019. The Polarization Effect. Healing our Worldviews.

If this is of interest, please also see Gail Bradbrook’s thinking (she's co-founder of Extinction Rebellion).

Postscript:

In case you're wondering why I used a picture of an Axolotl, a Mexican Salamander, for this item, it's because Axolotls are Masters of Regeneration.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...