The biggest banks in the world are regularly advertising their green credentials, whilst killing the world. They claim to invest in green projects, which are trivial to the amounts they are lending to companies creating emissions and destruction. It’s kind of like a family where you say aren’t we good and then spending the evenings running a Texas chainsaw massacre.

Case in point? HSBC.

I’ve blogged about them several times before:

In fact, they’ve been advertising their climate concerns for over a decade.

I remember walking through Heathrow airport where the bank advertised their climate activities all across the airport. I blogged back in 2016 about their Water Programme, a partnership between the bank and Earthwatch, WaterAid. the World Wildlife Fund (WWF) and local project partners, with the objective of providing and protecting water sources, informing and educating communities, enabling people to prosper and driving economic development across the world.

All good and, fyi, they've been advertising their green credentials for over a decade ... but it’s all a veneer. A sham. A thing we call greenwashing. As with their big bank brethren, HSBC runs the PR of being green, whilst being dark. HSBC is Europe’s second largest bank funder of fossil fuels and invested £81 billion into fossil fuel projects between 2015 and 2021.

As The Guardian reports:

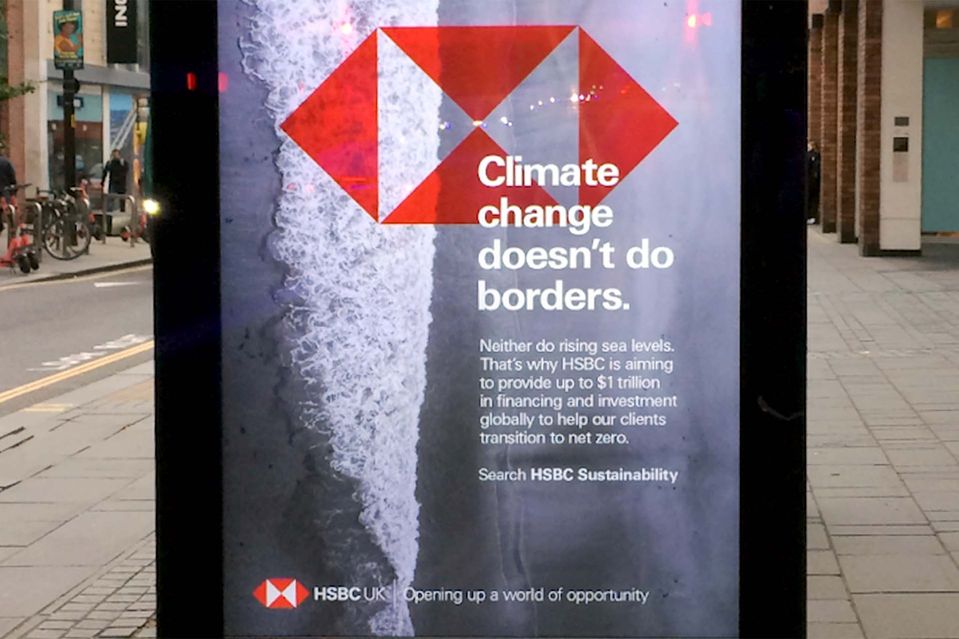

HSBC has suffered a fresh blow to its green credentials after the UK advertising watchdog banned a series of misleading adverts and said any future campaigns must disclose the bank’s contribution to the climate crisis.

The ruling by the Advertising Standards Authority (ASA) followed dozens of complaints over posters that appeared on high streets and bus stops in the lead-up to the Cop26 climate change conference last October.

The watchdog said the adverts, which highlighted how the bank had invested $1tn in climate-friendly initiatives such as tree-planting and helping clients hit climate targets, failed to acknowledge HSBC’s own contribution to emissions.

So much for this https://www.sustainablefinance.hsbc.com/

In particular Stuart Kirk, the former head of HSBC’s responbile investing, summed it up well:

“The average loan length in a big bank like ours, HSBC, is six years. What happens to the planet in year seven is irrelevant.”

His speech told the real truths of how HSBC, and most banks think which is: as long as we make our profits, returns and get a bonus, we don’t give a frack.

Therefore, it is a surprise to find that the regulators are now waking up to bank greenwashing, finally. The UK’s Advertising Standards Authority finally slapped a ban on HSBC claiming they were green, when they’re not.

The Guardian’s discussion continues:

HSBC’s latest annual report said its financed emissions – clients and projects it provided loans and services to – were linked to the release of 65.3m tonnes of carbon dioxide a year. That figure only accounted for its oil and gas clients but would probably be much higher if other carbon-heavy industries such as utilities, construction, transport and coalmining were included, the ASA noted.

The watchdog ruled that HSBC had to ensure any future environmental claims were “adequately qualified and did not omit material information about its contribution to carbon dioxide and greenhouse gas emissions”.

About time …

… in fact, what really gets my goat is when I walk through an airport and see HSBC’s adverts about the world of the future and water as a currency knowing that they absolutely don’t believe in what they say.

Stop it!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...